Canada offers many opportunities to foreign nationals worldwide. Canada has a well-deserved reputation for being one of the friendliest places. Canada has an incredible lifestyle and hence, it’s the best place to move with your family.

We all are aware that in past few years the covid-19 pandemic conditions have highly affected the financial structure. It has been difficult to plan for a bright future or to have a clear vision, as the political stress continues to grow while the economy has fallen worldwide.

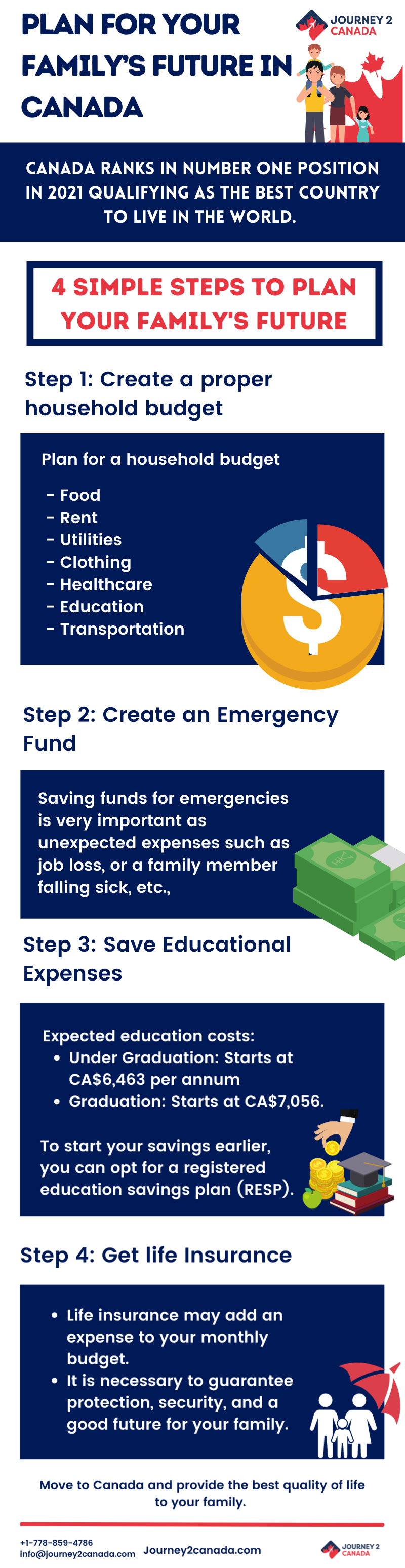

However, Canada ranks in number one position in 2021 qualifying as the best country to live in the world. Canada offers stability, safety, security, and the best quality of life not only to its citizens but to foreign nationals too.

4 Simple Steps to plan your family’s future

Canadian government takes control of major expenses such as healthcare and subsidized education. You still need to plan your finances carefully as there could still be some costs involved like higher education of your children.

Although financial planning seems daunting at first, it is easier than you think. Here are 4 simple steps to ease your task:

Step 1: Create a proper household budget

If you do not have a proper household budget, you might get into trouble. The more dependents you bring with you to Canada, the more expensive will be the cost of living.

The expenses required to raise a child until they turn 18 will be between CA$ 10,000 and CA$15,000. This figure represents only the basic needs of a child and excludes other additional activities, lessons, or sports that your children might want to take part in. While you plan for a household budget, it is necessary to consider all your basic expenses, including:

- Food

- Rent

- Utilities

- Clothing

- Healthcare

- Education

- Transportation

Once you plan your basic expenses, you can focus on the amount that you want to save. If you want to lower the cost of living, try to avoid unnecessary expenses.

Step 2: Create an Emergency Fund

If you’re in Canada with your family, saving funds for emergencies is very important as unexpected expenses such as job loss, a family member falling sick, etc., can pop up at any time. So, saving enough money in an emergency fund is also important.

The best way to save your emergency fund is to transfer it to a specific savings account. During the emergency, you will have at least three to six months of money in the cost of expenses saved at any time.

Step 3: Save Educational Expenses

As Canada has some of the best universities in the world, the cost of education for higher studies won’t be cheap. Hence, it is best to start your savings as early as you can. As per the top universities in Canada, you can expect the education costs starting at CA$6,463 per annum for an under-graduation degree, and for graduation, it starts at CA$7,056.

The above expense is the tuition fees excluding other expenses such as travel and student accommodation. To start your savings earlier, you can opt for a registered education savings plan (RESP). This is a tax-preferred savings plan that helps you to save for your children’s higher education. If you have more than one child, you can also apply for family RESP.

Step 4: Get life Insurance

It is one of the common things that many families do not have life insurance. But if you live in Canada with your children, it is recommended to have one. This is important especially during unpredictable difficulties like Covid-19 Pandemic.

Life insurance may add an expense to your monthly budget. But it is necessary to guarantee protection, security, and a good future for your family. Life insurance can help you to protect your family if something bad happens to you or your spouse/ common-law partner.

Also Read: Tips for newcomers in Canada

Canada provides the best quality of life to its residents as the government truly cares about the country and its people. Move to Canada and provide the best quality of life to your family. Book your appointment with us to know about immigration to Canada.